Table of Contents

Summary: AI is a game-changer in the banking sector by making customer satisfaction better, identifying potential fraud, and making business operations efficient. Apps such as chatbots and robo-advisors implement personalized services in banking thus making the process secure and efficient. This integration makes it possible to herald smarter future financial prospects.

The term, artificial intelligence, normally abbreviated as AI has emerged as a critical player in many industries, including the banking sector, revolutionizing AI personal finance management. Since AI technologies are evolving at a very high rate, most banking institutions are using AI in relation to customer relations, risk evaluation, business process automation, and product customization. Therefore, AI usage in banking is not just a trend; it is revolutionizing the categorization of handling our funds.

Why is AI Essential for Modern Banking?

1. Transforming Customer Experience in Banking

The customer experience is now one of the many battlegrounds where banks try to out-compete one another. Thus, AI solutions help banks address the sophisticated and high-level requirements of their customers and deliver high-quality, efficient, and integrated services, essential in finance app development.

By doing so, the use of artificial intelligence in banks can help banks to learn and understand the customers’ behaviors and preferences hence facilitating the delivery of relevant products and services through AI personal finance apps. Such customer segmentation not only serves the utility of improving customer satisfaction but also of creating customer loyalty.

2. Enhances Efficiency and Reduces Operational Costs

AI replicates many small and often monotonous tasks and enhances the performance of operations considerably. Examples of using AI range from answering simple customer questions through AI apps for finance and chatbots to administration tasks of the back office, like documentation checks and transaction supervision, freeing up human employees’ time for more valuable work. This automation results in high benefits since the banks will be in a position to operate with relatively less resources.

3. AI is Crucial for Staying Competitive in the Financial Industry

Technological advancements are as a result being embraced at a faster pace in the financial industry, with an increased application of AI; therefore, any bank that is not delivering AI tools for financial advisors is on the wrong side of the ledger as far as competition is concerned.

The main benefits of AI implementation here can be summed up as follows: AI helps banks to introduce new and valuable services to their clients and gain competitive advantages, manage risks more effectively, and adapt quickly to the existing tendencies in the market. With the help of artificial intelligence, banks can leave competitors behind and get more clients’ attention.

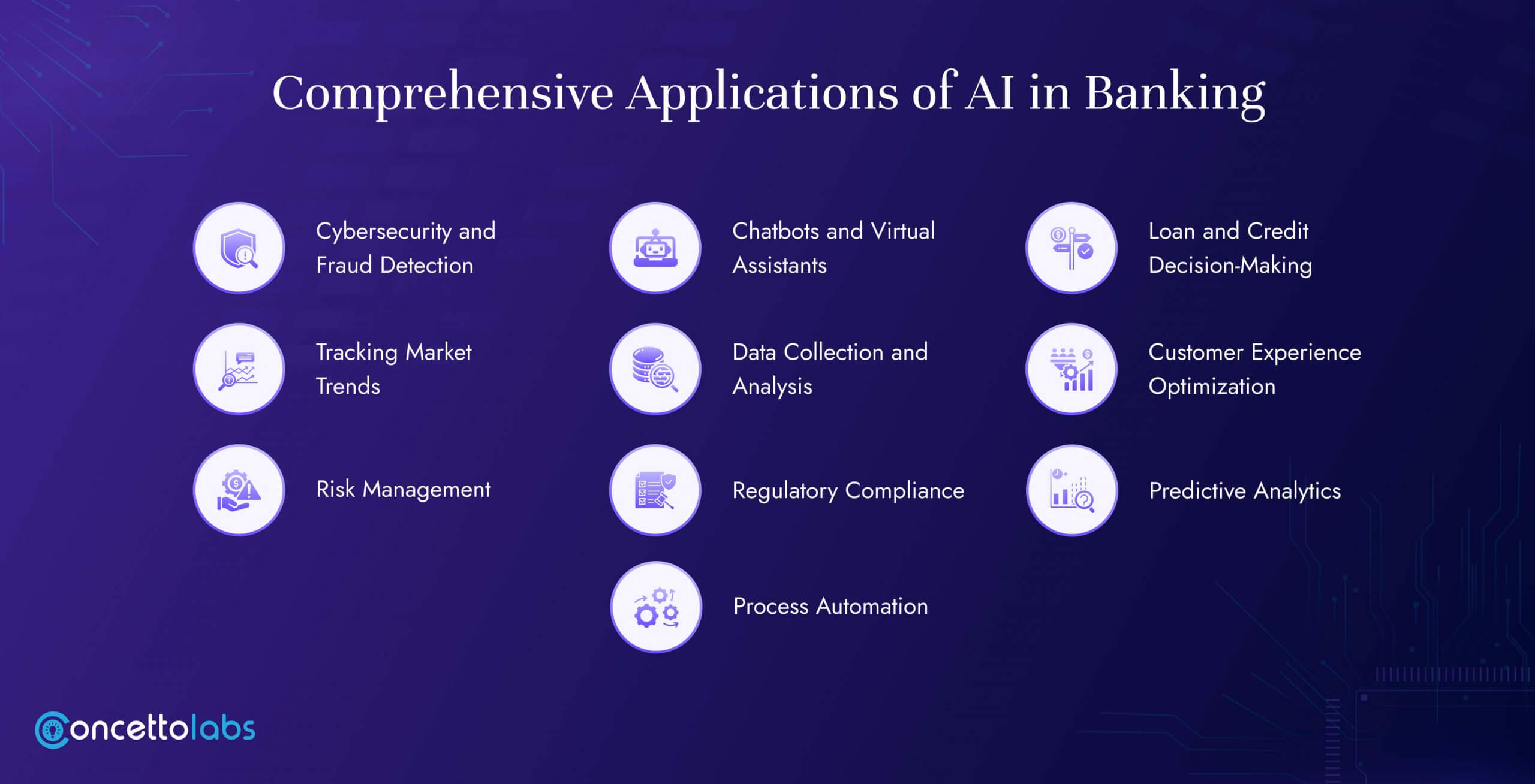

Comprehensive Applications of AI in Banking

1. Cybersecurity and Fraud Detection

The intervention of AI is critical in the improvement of the security of financial transactions. With the help of machine learning, the enormous number of transactions is examined in terms of spending patterns and deviations from them that could be attributed to the actions of fraudsters.

AI systems can recognize large amounts of data in real time, analyze them detect possibly fraudulent transactions and report this with additional data. It can be used to address fraud before it happens thus acting in the best interest of the bank as well as its customers through AI money management systems.

2. Chatbots and Virtual Assistants

AI-supported chatbots and virtual assistants are reshaping customer support in banking. Such smart solutions can address virtually any customer question regarding the balance on their accounts or specific recommendations on financial operations through AI personal finance apps. It helps the customers as they get immediate responses and support from the web chat at any time while the human agents can focus on the difficult problems.

3. Loan and Credit Decision-Making

AI is revolutionizing loan and credit decision-making, an important aspect of on-demand fintech app development. The conventional system of evaluation of credit risk, it is normally based on a few attributes and qualitative analysis. On the other hand, the AI models are capable of not only processing the large amount of data, but the non-structured data required when determining an applicant’s credit risk. This results in higher efficiency of loans’ approval and issue, which is good for both sides as the bank and the customer.

4. Tracking Market Trends

The analysis of the market trends is important through the use of AI tools and it is crucial when it comes to investment decisions. The knowledge concerning market changes or at least their possible shifts can be provided by AI algorithms based on the data collected from the financial news social networks and other sources. This in turn assists the banks and the clients to make the right investments at the right time.

5. Data Collection and Analysis

The use of AI in decision-making is ideal since it is effective in the collection and analysis of big data, a service often provided by an AI and ML development company. Therefore, in banking, this capability is essential in assessing client behavior, and patterns and making proper decisions from available data. AI helps the banks get the analytics that enable them to support business development and implement innovations.

6. Customer Experience Optimization

AI helps banks offer customers personalized services and thus improve their banking experience. The AI can also analyze data, thus predicting customer requirements and expectations to help the banks meet those needs with products and services. This creates more customer satisfaction and therefore, more customer loyalty.

7. Risk Management

Risk management is an essential part of banking and AI in the banking sector is revolutionizing the method used to identify and minimize the risks involved. Since the application of AI models involves using past data to come up with alternative solutions, it can be used to spot areas of risk like credit risks, and risk in specific markets, among others. Such measures enable the banks to be proactive to avoid falling into these traps and thereby reduce their exposure to the risks.

8. Regulatory Compliance

Another challenge faced by banks is to strictly comply with legal laws. AI makes this process much easier because compliance can be monitored and all reports can be created automatically. It also means that through AI systems banks can effectively analyze the transactions and compare them with the current regulating policies to contain any breach.

9. Predictive Analytics

Big data and analytics help in the trending and foreseeing of future trends to enable the banks to make prior decisions. With a look at past data, AI systems are capable of forecasting customers’ behavior, changes in the market, and any other relevant factors. This means that through such foresight banks can prepare and avoid getting caught off guard and make strategic plans.

10. Process Automation

Automation using artificial intelligence in the various undertakings of banking services such as account opening or loan application. When integrated into the banking system, LAR can help banks in costing down expenses, increasing efficiency, and adding value to the clients. As such, Automation shortens the time it takes to complete a process, hence shortening the time taken to attend to customers.

How AI Enhances Cybersecurity and Fraud Detection

AI Algorithms for Detecting Fraudulent Activities

Machine learning techniques work effectively in recognizing subtle characteristics of transaction data to identify fraudulent transactions. Machine learning models evolve as they learn from the previous data, so their accuracy increases. These algorithms may be used to find such things as anomalies, such as changed spending patterns, changes in transaction activity, and all such things related to fraud.

Machine Learning for Monitoring Suspicious Transactions

With machine learning models, it is possible to track transactions in real time, and any activities that look suspicious can be reported. For instance, if a client’s account is displaying new and frequent activities or originates from a strange place, the AI system can notify the bank’s security. This proactive monitoring is very useful to discourage and detect fraud and guard customer’s accounts.

Case Studies of AI in Fraud Prevention

Many banks have applied AI approaches to automatically detect fraud. For instance, HSBC bank has implemented intelligent equipment that computes and analyzes data from transactions to flag suspicious fraud. This indeed shows that the system has helped the bank in minimizing false positives thus concentrating on the real threats. In the same manner, JPMorgan Chase applies AI for credit card purchases and tracing of fraudulent activities in their system.

How AI-Powered Chatbots and Virtual Assistants Improve Customer Service

Benefits of AI Chatbots for Customer Interactions

There are many advantages of using AI chatbots in customer interactions. They give real-time answers to the inquiries and hence cut down on the response time and thus increase customer satisfaction. Chatbots can carry out a lot of questions, from basic to severe in the financial business, and deliver accurate responses consistently. Further, in most cases, these chatbots work round the clock hence guaranteeing clients the availability.

Use Cases of Virtual Assistants in Banking

Artificial intelligent virtual assistants are in all degrees of banking applications. For instance, an AI virtual personal assistant by Bank of America based on its application named Erica assists customers in controlling their finances, the amount spent, and providing relevant advice on monetary matters. With the help of Erica, it is also possible to receive some account information such as balances and transaction history as well as bill payments.

Real-World Examples of AI Chatbots in Banks

Some of the major branch banks have adopted the use of AI chatbots to deliver better service to customers. For instance, an application by the name of Wells Fargo has an artificial intelligence chatbot that helps customers with their banking activity. The chatbot’s function is the ability to answer questions, give advice on a financial position, and process a transaction. Likewise, Eno is Capital One’s AI entity that assists customers in checking their account balance and spending patterns and notifies them of any illicit transactions.

Real-World Examples of AI in Banking

Leading Banks Implementing AI Technologies

Many major financial institutions have managed to adopt AI technologies as a means of improving their operations. For instance, JPMorgan Chase applied the technique in the screening and extraction of information from legal documents to the process of document review. In the same way, AI chatbots also apply in customer service in this company as they reduce customer waiting time hence increasing the level of satisfaction.

Success Stories of AI Applications in the Financial Sector

Many financial institutions have claimed massive gains from automating Artificial Intelligence. For instance, Bank of America’s virtual assistant has invoked Erica, which is an artificial intelligence that assists its customers in managing their money, keeping track of expenses, and offering advice. They have increased customer satisfaction and their interaction level being a key example of applying AI into banking.

Challenges in Adopting AI in Banking

1. Data Security Concerns

One of the key risks arising from adopting AI in banking is data security. AI systems often involve analyzing large amounts of customer data that are often regarded as private and sensitive. Lenders need to guarantee that AI le used in their institutions are safe and do not infringe on clients’ privacy since their information is held on those systems.

2. Lack of Quality Data

The effectiveness of the AI models is hugely determined by the training data fed into the models. Missing, distorted, or biased analysis of the information can result in planning and forecasting a wrong course of action. Banking organizations need to commit resources to data quality management since the data used for creating AI systems should be accurate.

3. Explainability and Transparency Issues

Currently AI models can be hardly explained and understood, so they are called “black box”. This is regrettable because such processes lack explainability and transparency, attributes that can be problematic in the context of banks having to defend their decisions to regulators. Thus, banks need to focus on the creation of explainable AI models to learn more about their decision-making patterns.

4. Integration with Legacy Systems

AI can be integrated with existing legacy systems and as you know dealing with legacy systems is not a simple endeavor. To be significant, the applications shall continue to adapt themselves to the existing bank’s structure or environment and be able to integrate with other systems. Some of these may be capital intensive hence calling for enhancement of technology and other resources.

How Concetto Labs Can Help in Your AI for Banking Journey

Concetto Labs provides an extensive catalog of AI solutions designed specifically for banking. With a team of experienced consultants and developers, Concetto Labs can take care of all aspects of banks’ AI initiatives from designing a strategy to implementing a solution and subsequently supporting it. We have a pool of professional AI personnel who possess adequate knowledge in designing and integrating effectual AI solutions in organizations.

Conclusion

Artificial intelligence is a radical new technology that is significantly changing how finances are handled, providing huge chances to banks on how they can improve their service delivery and provide value to customers. Right from customer relationship management, risk management, investments, and compliance, AI is entering nearly every aspect of banking. In a future analysis of the integration of the banking industry, one can conclude that as a result of AI, banking becomes more efficient, secure, and personalized.

Table of Contents

Indonesia

Indonesia

Botswana

Botswana

USA

USA

Italy

Italy

Panama

Panama

USA

USA Canada

Canada UK

UK Norway

Norway India

India Australia

Australia